Over the last 3 years on average earnings per share has fallen by 4 per year whereas the companys share price has fallen by 3 per year. The EVEBITDA NTM ratio of Nestle Malaysia Bhd.

Solved Below Data Extracted From Annual Report Of Nestle Chegg Com

Nestle used to manage its place in the market via the adoption of the accounting method.

. As of 2021 they employed 525k people. Financial analysis Financial analysis is the selection valuation and interpretation of Study Resources. It was listed on the Malaysian stock exchange in the year 1989 at RM52 a share.

The company has an Enterprise Value to EBITDA ratio of 2824. Price to earnings ratio. It is stated herein financial analysis assignment that according to the survey every year Unilever is having 26 of profit growth annually Annual Report Nestle 2019.

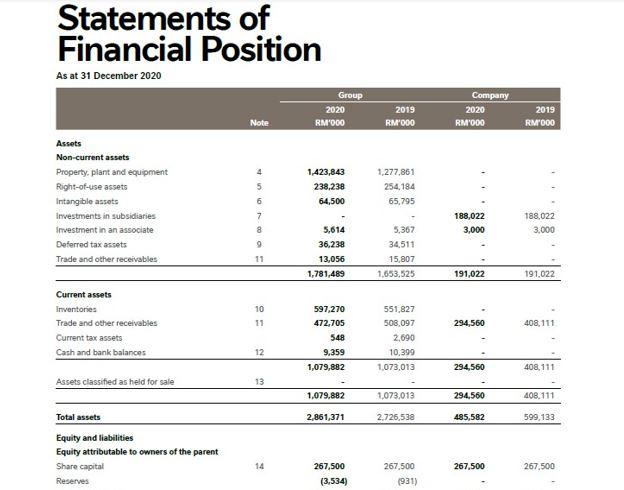

21 Short-Term Analysis 27 22 Long-Term Analysis 30 23 Different Risks in which Nestlé is exposed to 33 24 Market Analysis 37 25 Conclusions 39 BLOC 3. It champions nutritious health and wellness products. 1 The Group has adequate credit facilities to fund the net current liabilities.

2 In accordance with Section 618 2 of the Companies Act 2016 the share premium amounting to RM33000000 has become part of the Companys share capital in 2017. Price to cash flow ratio. 2 Nestle Malaysias Financial PositionBalance Sheet Table 2.

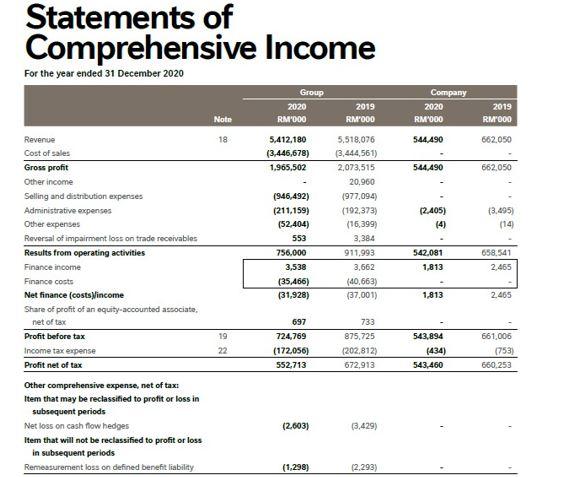

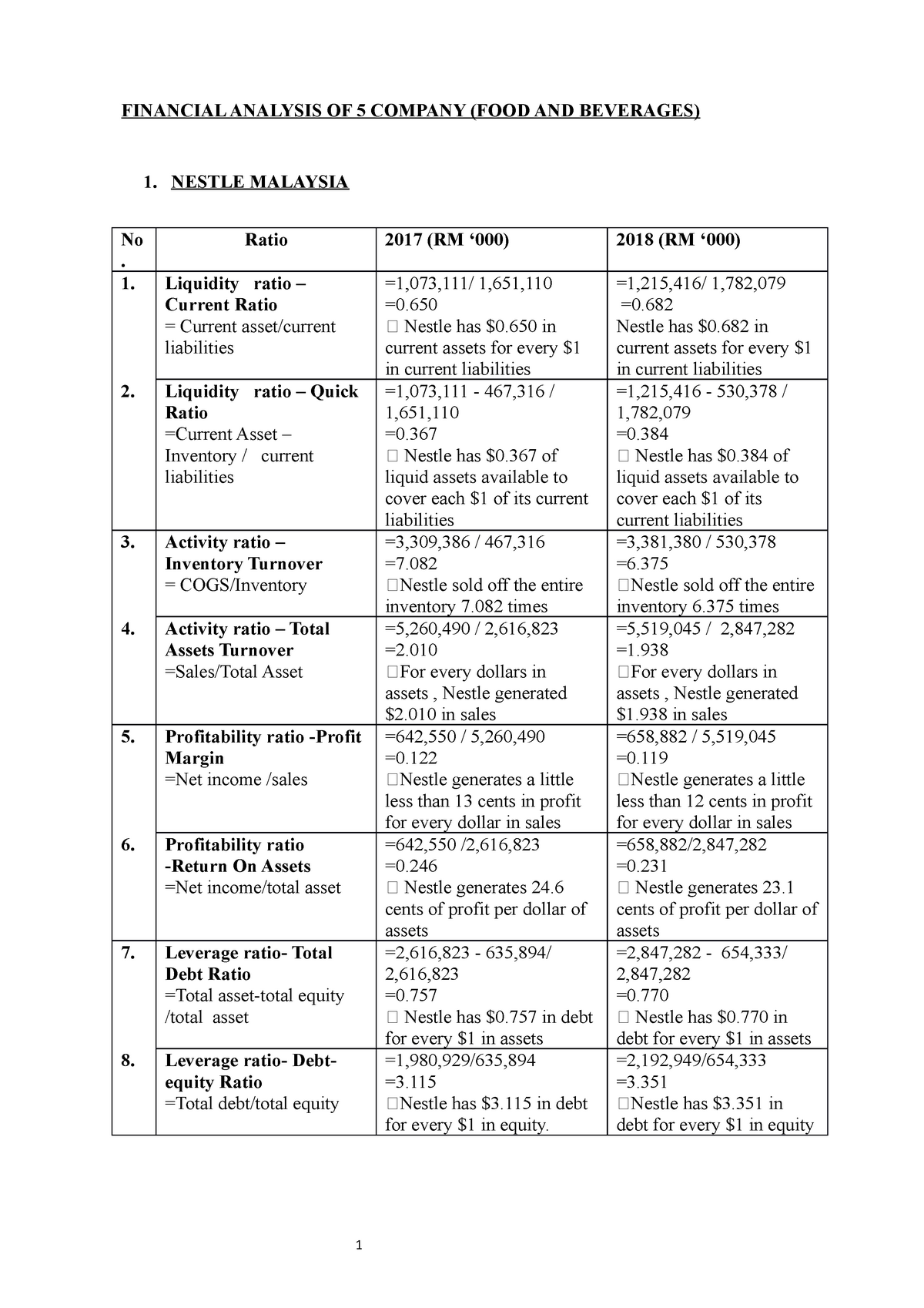

The report outlines the main financial ratios pertaining to profitability margin analysis asset turnover credit ratios and companys long-term solvency. Nestle Malaysia Berhad is a Malaysia-based company which is a food and beverage FB manufacturer. NESTLÉ MALAYSIA BERHAD.

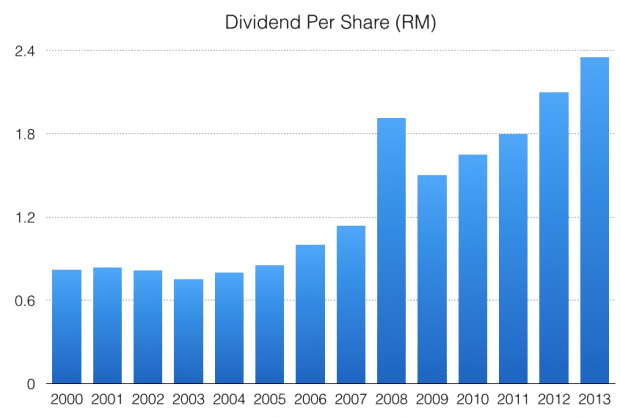

Today Nestlé Bhd has delivered major windfall returns to shareholders. For The Year Ended 31 December 2021. Is significantly lower than its historical 5-year.

According to these financial ratios Nestle Malaysia Bhds valuation is way below the market valuation of its sector. PROFITABILITY ANALYSIS 40 31 Return on Equity ROE Analysis 41 32 ROE Before Taxes 44 33 Tax Impact Analysis 44 34 Return on Assets ROA Analysis 46. NESTLE M BHD key financial stats and ratios.

Financial Reporting and Analysis. Nestle was founded in 1886 by Henri Nestle. Nestlé Malaysia Berhad is a multinational food manufacturing and marketing company.

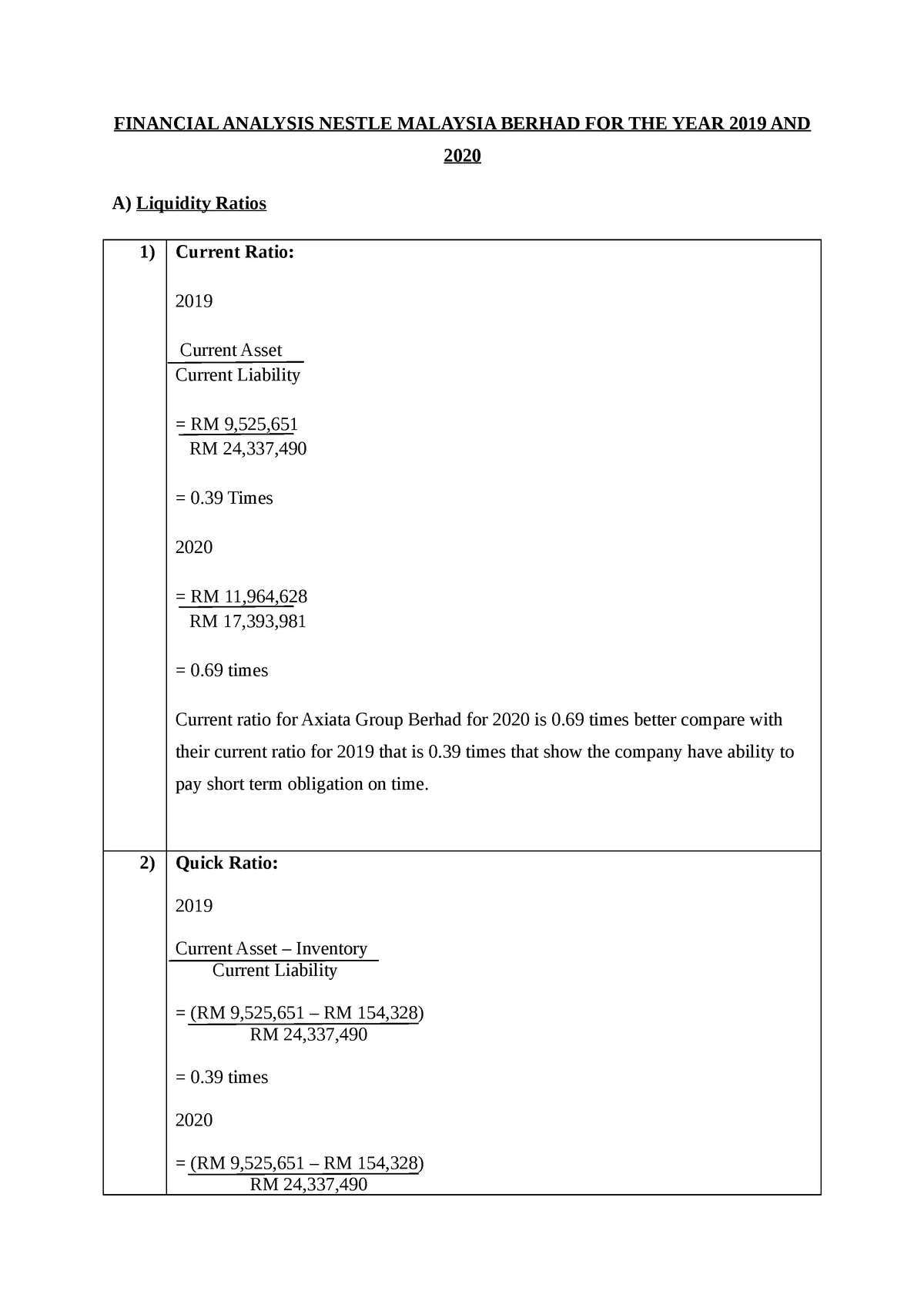

A beginners guide to the key financial ratios 1st ed. NESTLE BURSA MALAYSIA. FINANCIAL ANALYSIS NESTLE MALAYSIA BERHAD FOR THE YEAR 2019 AND 2020.

BUSINESS ANALYSIS ON NESTLE MALAYSIA BERHAD. And make sure their analysis is clear and in no way misleading or deceptive. View Nestle Malaysia Financial analysis docx from FINANCE ABMF3174 at Tunku Abdul Rahman University.

Click here to view in mobile. Nestlé Malaysia Berhad reported earnings results for the second quarter and six months ended June 30 2022. 0030 001report analysis financial year 202.

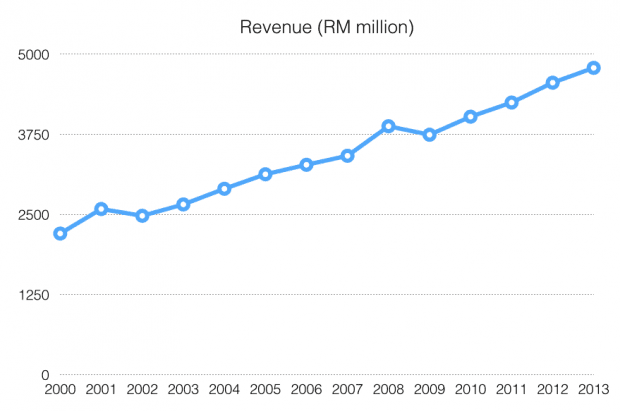

NESTLE price-to-sales ratio is 505. Nestle Malaysia Bhd balance sheet income statement cash flow earnings estimates ratio and margins. Over the next year revenue is forecast to stay flat compared to a 38 growth forecast for the industry in Malaysia.

Nestle Malaysia analysis. 3 The market price represents. Danone is having 32 of the profit growth every year.

The most impressive thing is the company been able to reduce the. It started off with one mans initiatives to produce infant formula for infants who are intolerant to their mothers milk and grew into a multi-national cooperation worldwide. The Nestle Malaysia Bhd.

The study indicated that. Is significantly lower than the average of its sector Food Products. This table contains critical financial ratios such as Price-to-Earnings PE Ratio Earnings-Per-Share EPS Return-On-Investment ROI and others based on Nestle Malaysia Bhds latest.

View 4707MY financial statements in full. BBMF 2023 RBF Group 1 Nestle Malaysia Berhad. Income statement Balance sheet Cash flow Statistics.

The Company operates through two segments. 201 Tangible Resources a Financial Resources Nestle Malaysia Berhad has always managed its cash well. Current Asset Current Liability RM 9525 RM 24337 0 Times.

In the financial year 2011 the food industry had generated RM 47 billion with an operating income of RM 5801 million. Forcasts revenue earnings analysts expectations ratios for NESTLÉ MALAYSIA BERHAD Stock NESTLE MYL4707OO005. Nestle Malaysia Bhd Stock Financials 4707 Morningstar Rating Rating as of Aug 2 2022.

10 in line with 2Q 2021. RM1697m up 26 from 2Q 2021. The EVEBITDA NTM ratio of Nestle Malaysia Bhd.

Financial analysis covers the income statement and ratio trend-charts with balance sheets and cash flows presented on an annual and quarterly basis. The data is obtained from the companys financial statements during 4 years. Using Financial Accounting Information 11th ed.

NESTLÉ MALAYSIA BERHAD. Trading strategies financial analysis commentaries and investment guidance for NESTLÉ MALAYSIA BERHAD Stock BURSA MALAYSIA. The Companys product category includes dairy coffee foods ready-to-drink.

Food Beverages and Others which includes e Nutrition Nestle Professional N estle Health Science and NESPRESSO. This study is an assessment of Nestle SA company by adopting financial ratios analysis.

Financial Analysis On Nestle Bz20503 Basic Financial Management Ums Thinkswap

Financial Analysis On Nestle Bz20503 Basic Financial Management Ums Thinkswap

Nestle Financial Statements 2016

Nestle Malaysia Berhad Revenue 2020 Statista

Nestle Financial Analysis 3 Years Pdf Accounting For Business Decision Making Mbsa1413 Prepared For Dr Zarina Abdul Salam Financial Ratios Course Hero

Solved Below Data Extracted From Annual Report Of Nestle Chegg Com

Nestle Malaysia Berhad Kaya Plus

Fm Assignment 5 Companies Financial Analysis Of 5 Company Food And Beverages 1 Nestle Studocu

Ratio Analysis Of Nestle Malaysia Berhad Youtube

5 Things I Learned From The 2020 Nestle Malaysia Agm

Financial Analysis Ratios Analysis Report 2021 Financial Analysis Nestle Malaysia Berhad For The Studocu

Financial Analysis On Nestle Bz20503 Basic Financial Management Ums Thinkswap

Pdf Financial Ratio And Macroeconomics Dynamic Determinants Of Financial Risk In Nestle Malaysia Ge Runzheng

Nestle Malaysia Berhad Kaya Plus

7 Reasons Why Nestle Malaysia Is On My Dividend Watchlist

Dutch Lady Milk Industries And Nestle Malaysia Ebf1323 Principles Of Accounting Unimas Thinkswap

Malaysia Stock Analysis Report Nestle 4707 I3investor

Pdf The Relationship Between Risk And Performance Of Nestle Malaysia Berhad

7 Reasons Why Nestle Malaysia Is On My Dividend Watchlist